New trends show up on social media every day, but just because something is popular does not mean the content will be valuable for your audience. Some are innocuous, like changing your profile picture to a specific emoji, while others are more significant, like starting to use Instagram Reels.

With 2022 just around the corner, you may be wondering if it’s worth it to continue following trends on Instagram. It can be time-consuming and may not be worth your while if you’re not getting anything out of them. Additionally, some of them are simply silly, and you may not want to be associated with them.

Here’s what you need to do to decide what works best for you. Your judgment and instincts will decide what Instagram trends in 2022 to follow that are right for you.

Social Justice on Social Media

In a world where social media plays a significant role in communication and networking, it’s essential to be aware of the latest trends and developments. By following trends, we can learn about new issues and perspectives, and we can also find new ways to take action on the issues that matter to us. Social justice has become a popular movement on social media over the past few years as people become more aware of the social injustices around them.

So, while it may be challenging to keep up with all the new trends, it’s worth it to try. In an increasingly connected world, we have a responsibility to use our voices to stand up for what’s right.

Organic Reach Just Isn’t Enough

Organic reach isn’t enough anymore. To reach your target audience, you need to engage in the latest trends. This means research and using relevant hashtags. The good news is that Instagram trends tend to be pretty short-lived, so if you miss one, give it a few days, and another popular trend will pop up.

Creators are Kings

It is always important to be ahead of the trends. Staying ahead of the trends will make you relevant and allow you to continue to grow your audience. However, there is a fine line between following trends and becoming a sheep. You don’t want to be someone who follows the trends because everyone else is doing it.

You want to be a trendsetter. Be the person who starts the trends. This is how you will become a king or queen of your niche.

The Dance Revolution Continues

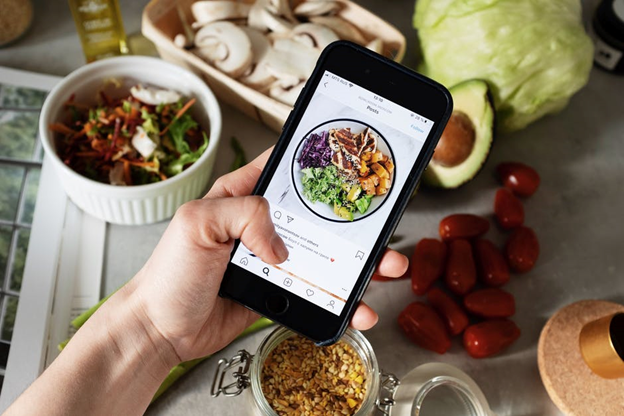

Social media platforms such as Instagram have become a massive part of our lives, with people using them to share everything from their thoughts and feelings to what they had for breakfast.

If you love to express yourself through dance, then following the trends on Instagram in 2022 could be a great way to connect with others who share your passion. With the continued rise in the popularity of dance videos on social media, there’s no doubt that the dance revolution will continue to grow in the coming years.

The Return of the Chronological Feed

With the return of the chronological feed, users can see posts in the order they are posted rather than the algorithmic feed currently used. This means that users will be able to see posts from the people and brands they follow as soon as they are posted rather than seeing posts that Instagram thinks they will engage with the most.

This change will benefit users who want to keep up with the latest trends and see new content from their favorite brands and influencers as soon as it is posted.

“Add Yours” Collaborative Albums

If you’re considering following this trend, ask yourself if it aligns with your goals for your account. If you’re looking to stand out and be creative, go for it! But if you’re just trying to keep up with the latest trends, you might want to rethink your strategy.

Collaborative albums, or “add yours,” started in 2020 and allows users to contribute photos to a shared album. This is a great way to show off your creativity and connect with other users.

Live-ing it up on Instagram Trends Live

Live streaming allows you to interact with your followers in real-time. You can give them a behind-the-scenes look at your life, answer their questions, and build a stronger connection with them. The best part about live streaming is that you can do it anywhere. All you need is a smartphone and an internet connection. Whether you’re at home or on the go, you can go live and give your followers a glimpse into your world.

Replying with Reels

Reel replies are becoming more popular and are a great way to show off your creative side. They are also a great way to get more views on your Instagram account.

If you’re thinking about following trends like replying with reels on Instagram in 2022, it’s worth considering what you’re hoping to gain. Whether it’s increased brand awareness or more sales, make sure you’re clear on your goals. Then, follow the trends that make the most sense to grow your online business. And, as always, don’t forget to have fun with it!

Some Trends Can Help Grow Your Social Media Presence

If you want to stay ahead of the trends, Instagram is a great platform to follow. With over one billion active users, it’s a powerful tool to see what’s popular and what’s not. While some Instagram trends come and go quickly, others have more staying power.

Are you interested in learning more about social media? Check out our other articles on how to grow your online presence.