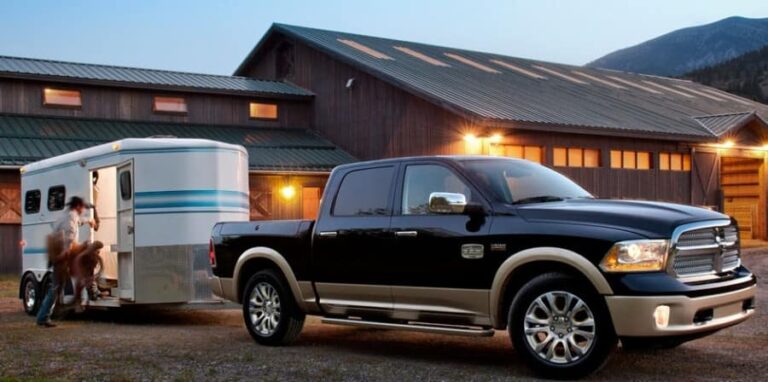

Having handy transportation will elevate a company’s capability to provide the best customer service. Trucks are the ideal choice for any business as it assures an ample amount of space to equip all the essentials.

For instance, an electrician will need all the wiring supplies when he visits the residential or commercial projects. It will be easier to carry the necessary equipment to the site safely with a truck.

The trucks are not just helpful for electricians. A florist delivering floral arrangements or an excavation company carrying the necessary equipment will need the best truck to reach the work destination safely. Such an essential element of your business shouldn’t be purchased randomly.

You will find innumerable dealers but consider buying the vehicle in genuine truck sales and select dealers who offer the best vehicles at an affordable price. If you are ready to splurge the hard-earned money in a good truck, utilize our guidelines and select the best models available in the market.

Cost

Recent reports reveal that people in Australia are spending more on buying trucks. Before you buy a truck, cost is one factor that you shouldn’t ignore. Start checking the prices online. Whether you desire to purchase new or used vehicles, evaluate how much it will cost you.

You will have a budget and desire to find the best trucks without burning holes in your pocket. If you see the available options, it will help you make informed decisions. For instance, second-hand trucks from another business will be available at a lower cost. You can utilize the time to compare prices and narrow down the options before you choose one.

Find the reason for sale if you prefer used trucks

When you consider used trucks, the first thing you have to check is the reason for truck sales. Business owners have various reasons to sell the vehicle, and it heavily impacts your buying decision.

If the reason behind a truck’s sale is underperformance or high maintenance, it is better to look for other options. You might find these trucks at a low price, but they are going to cost you a lot in the long run.

You shouldn’t splurge more in maintenance or repairs as a business owner. Buy trucks from another business if they quote the reason as “upgrade”. It implies there is no problem in the truck, but you can scrutinize it before buying it.

Check mileage

Mileage is the most critical element you need to consider when choosing the trucks. Request the maintenance records from a seller to know what parts you will need to buy in future for the truck. When you consider used trucks, there will be some expenses like repairs or replacement. A worn-out tire necessitates business owners to find a suitable replacement and ensure you are ready to deal with those charges.

Wrapping up

If you choose the right truck, it will last a long time. Primarily, consider vehicles that are in good condition. It is better to stay away from expensive or poorly performing trucks. For new business owners, used trucks are a good choice as it is cost-effective. Consider every factor to select the best trucks. Whether it is a new or used truck, the vehicle will support your business and make sure you find the best.