A financial forecast is an estimate of how a business will perform in the future. It gives you access to valuable insights, which allows you to develop long-term strategic plans that are realistic and feasible.

In addition to that, making financial assumptions are essential in attracting potential investors. But, unless these forecasts are reasonably accurate, they aren’t much of a help. Inaccurate forecasts can instead repel customers, even put you at risk of mismanaging expenses and running out of cash.

How do you create reliable financial assumptions? In this article, we share a few tips to help make your forecasts as accurate as possible.

How to Prepare a Financial Forecast

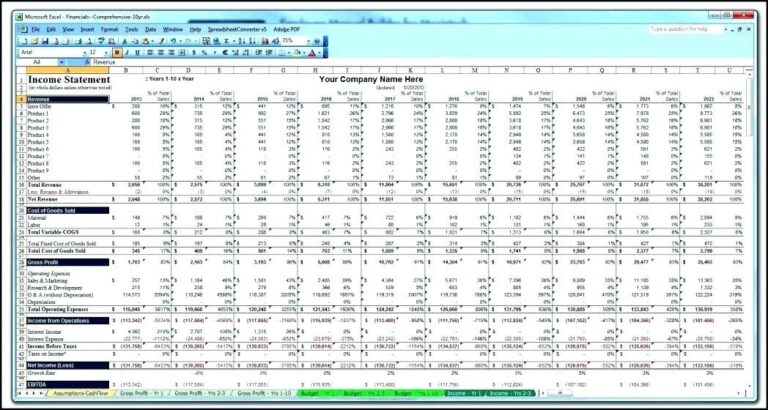

There are at least three financial statements covered in a forecast:

- Income statement

- Cash flow statement

- Balance sheet

In a nutshell, financial assumptions should be conservative and based on reasonable expectations in the next one to three years. Some agencies that provide financial modelling consulting services also suggest up to five years of forecast.

- Start with expenses

In general, you have more control over projecting your expenses than revenue. So, you might want to start with that. Estimate your fixed expenses including lease, utilities, maintenance, insurance, and cost of goods. These costs will occur every month, quarter, and year. From there, think about how your revenue would affect these expenses. For example, if it grows, you can expect the cost of goods sold (COGS) to grow as well.

Underestimating these expenses at this stage could mean the difference between your success and failure. Identify which costs you can forego in lean times or where you will invest for future growth.

- Base your projections on your market and industry

Research every aspect of your business represented on your projections. One search on the Internet and you’ll find financial statements for publicly traded businesses. You can access them for free and use them as a guide to create your assumptions.

It also pays to support this data with market research to discover your customer base and validate that there’s a market for your product, service, or technology. You can also compare your projections to the findings of competitors. It can be hard to find data on comparable businesses. But, at the very least, you can base your forecast on your operating history.

- Create multiple scenarios

It’s easy to be overly optimistic with your projections. However, the reality can often be more disappointing than it seems.

Therefore, it could be useful to create multiple versions of your forecast that reflect the following scenarios:

Aggressive – this predicts that your business will succeed in ways that exceed your expectations. For example, an optimistic assumption is that your sales will increase by 10%. But, on your aggressive forecast, your revenue will grow at 20% or more.

Moderate – this is the more logical version of your predictions. If you forecast 10% sales growth, it will reflect 10% sales growth

Conservative – Your worst-case scenario, a conservative prediction will reflect your business falling short of your expectations. In your predicted 10% growth, this forecast will reflect sales growth at anything less than 10%.

- Indicate your assumptions

Where are you basing these assumptions? Any reliable forecast should identify the factors on which you base the figures. These include things outside of your control—market fluctuations, number of competitors, and any technological developments that can impact your business.

- Review constantly

Your financial forecast is not a one-time project. You should evaluate it regularly to determine how close your actual results are to your forecasts. Update as necessary to reflect any new information.

The more you update your forecasts, the better you can make informed strategic decisions. It will also help you become more adept at forecasting costs and revenues and confident in making future projections.

If you need help with your financial forecast, you can consult a financial modelling agency to make valid and reliable assumptions. They have the expertise to perform research diligently with a focus on helping you understand your business plan and present it with potential lenders and investors.

Did you find this article helpful? Share your thoughts by leaving a comment.