‘How many accounts should I have?’ is a very common question. In the current times, many people have multiple savings accounts. Having more than one account can be very helpful if the use of the bank accounts is planned.

In this article, we will help you understand what is the ideal number of savings accounts, how to organise your bank accounts and the pros and cons of having multiple savings accounts.

Having more than one savings account lets you to segregate your income into various buckets. E.g., you can open a savings account to save money for emergencies or to save money to splurge such as concerts or an expensive purchase.

How to organise different savings accounts

If you want to get your money and finances sorted, earmarking different savings accounts for different uses such savings can simplify your life.

Save for emergencies:

Emergency fund is an essential financial necessity. A sizeable corpus with at least six months of expenses will act as a cushion during emergency situations such as job loss, urgent house repairs or car repairs. It is advisable to build an emergency fund before investing. However, building an emergency fund can take several months. If your focus is on saving money for emergencies, opening a new account to park your money can be a good start.

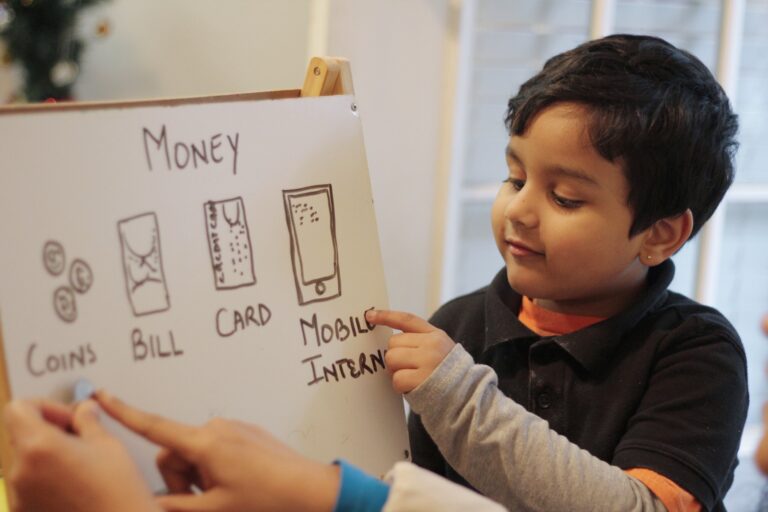

Decide the percentage of income that you want to save in the emergency fund. Transfer the amount at the start of every month to the new account through Net Banking or Mobile Banking. You can also automate the transfer. Try not to touch the account unless it is urgent.

Segregate expenses and savings into two different accounts:

If you receive your salary in an account, you can use that account to save or invest money. You can transfer the amount you are looking to spend on essentials and luxuries in a different savings account. In this way, you can save a pre-determined amount every month by setting up Systematic Investment Plan(SIP) to invest in Mutual Fund or save money through Recurring Deposit (RD). You can also convert your bonuses to Fixed Deposit (FD) with such a few clicks.

On similar lines, you can open a dedicated savings account for all your savings and investments and link your investments with the account.

Save up money for your splurges:

Do you dream about being in the front row of a rock show or purchase an expensive gadget? If you have long wishlist, opening a savings account to save for your so called ‘frivolous expenses’ will assist you in having a good time without draining your hard-earned money. So, allocate a certain percentage of your monthly income so you can take part in your guilty pleasures without feeling guilty.

Automate your transfers

Banks offer automatic transfers that customers can avail to transfer money from one savings account to other regularly. Set up automatic transfers from your primary account to other accounts so you don’t have to get actively involved in this process. If you don’t see the money, you won’t be tempted to spend the money.

Advantages of Having More than One Savings Account:

Here are some of the advantages of having multiple savings accounts.

Streamline your money: Having multiple savings accounts can help you streamline your expenses and savings, making it easier to track.

Save money: A new bank account can kick start your saving journey. Initially, you may not be confident about saving a certain sum of money regularly. Transfer any amount of money that you are comfortable to test the waters. As life happens, the amount that you can save every month may vary. Even so, it will be better than no savings at all. Moreover, if you are in a dire situation, you don’t have to go up to your friends or parents for financial help as you can easily withdraw from your account.

You can use the saved amount for your emergencies or investments.

Perks: Banks tie ups with various companies to offer discounts to their customers and differentbanks offer a host of different perks. Having more than one account will widen your hunt for the best deals.

Disadvantage of having multiple savings accounts

Maintaining minimum balance: Many savings accounts have a minimum average balance requirement that you need to maintain on a monthly basis. Failing to do so can attract penalties. So, if you have multiple savings account, maintain the minimum balance to avoid penalties.

Conclusion: Having more than one savings account can aid money management. If you are looking at opening a new bank account, you can look at Kotak 811 Zero Balance Savings Account.

Kotak 811 is a digital savings account with no minimum average balance, and you can open the account online at anytime from anywhere with no paperwork.