In case you are searching for a brand-new savings account, Chase is a great option to think about since you might be able to locate a branch close in which you live.In this post we will be discussing why open a Chase Bank Account.

If you want Chase’s comprehensive branch and ATM system in the United States, the Chase Savings account is the right choice – you will help save money and time while still getting convenience.

Nevertheless, you will find a plethora of alternate savings accounts accessible available nowadays. It’s the intention of ours to evaluate the Chase Savings account rates, fees, along with additional features – and also equate it to other savings account options.

Interest Rates

Although having a checking account is handy for saving cash on payments, it’s not likely that you’ll in fact be earning some cash.

A savings account has the benefit of guaranteeing interest and Chase bank provides its clients 2 choices to enhance their contributions and increase the amount of cash in their private Bank account.

You are able to select between a Chase Savings account and a Chase Plus Savings account, based on whether you would like to add another to your portfolio or begin with your very first account.

The minimum deposit needed to launch a Chase Savings and a Chase Plus Savings account is USD twenty five and USD 100, respectively, based on the account. The bank does not provide fixed interest rates on any of its products.

The Advantages and Disadvantages of a Chase Savings Account

Pros

- Bonuses for new accounts are given out on an irregular basis.

- It is possible to utilise it for overdraft protection.

- Access to physical branches

- Mobile app is available

Cons

- A cost charged on a monthly basis

When compared to internet savings accounts, the interest rate is significantly lower.

Rates are rather determined by the quantity of cash in the account as well as the type of account. All of the balances in a typical Chase savings account will produce a fairly small annual percentage yield (APY). This’s most likely nothing to be too pumped up about.

However, the good news is Chase gives you another method to boost your wealth. In case you wish to obtain a much better yield, you need to think about opening an account with Chase Plus Savings, as they provide a higher return rate.

If you do not link your Chase Plus Savings account to a qualifying Chase checking account, you’ll be charged an interest rate which is linked to the quantity of money in the account.

You are able to boost your earning potential by linking your Chase Plus Savings account to a Chase Premier Plus Checking account or a Chase Premier Platinum Checking account.

When you’re searching for virtually any kind of bank account, you have to do a little comparison shopping to find out what the various rates are, and to find out what other choices are available.

Even though the rates provided by Chase savings are usually above those provided by some financial institutions, they might not be as attractive as those offered by several online banks.

Having the capability to chat to a banker face-to-face when a problem comes up is essential to a number of individuals that prefer a brick-and-morty bank.

If you are not worried about face-to-face interaction, the return on an online high-yield savings account will most likely be a lot higher.

When compared to other online savings accounts, how does it fare?

In contrast to Chase, online banks are not required to pay the operating costs of maintaining physical locations.

This allows them to provide savings accounts with significantly greater interest rates, as well as account fees that are significantly reduced or eliminated.

Understanding the Monthly Fees for a Chase Savings Account

Once interest is earned on savings accounts, they can grow rapidly and easily. A lot of banks ask for a fee for their services, which is generally a monthly charge. The Chase Bank is simply one of those exceptions.

Monthly upkeep and service costs can rapidly exhaust your account balance. To be able to stay away from these fees, Chase provides its clients a number of choices.

The Chase Savings account includes a USD five monthly service fee, but the bank is going to waive this fee in case you meet a minimum of one of the following criteria each statement cycle:

Ensure that you keep a daily minimum balance of $300 or more

At least one recurrent automatic transfer of $25 from a Chase checking account has been set up for you.

You link your savings to one of the following Chase checking accounts: Chase Premier Plus Checking, Chase Premier Platinum Checking, or Chase Private Client Checking.

Monthly service costs, like interest rates, vary from financial institution to financial institution.

The Ally bank doesn’t charge a monthly service charge and doesn’t charge a fee for ACH transactions to accounts which are not held by the bank.

When it comes to competitors, American Express National Bank doesn’t charge a monthly service fee for its high-yield savings account, and you might steer clear of the USD 30 monthly service cost charged by Synchrony Bank in case you have a minimum balance of USD thirty in your savings account.

Another Fee to Keep an Eye Out For in Your Savings Account

You’re only permitted to make a particular amount of deposits and withdrawals from your savings account each monthly statement cycle, based on federal law (six withdrawals and transfers).

Transfers and withdrawals made on the spot at an ATM or branch of a bank aren’t subject to this restriction.

Chase Bank is going to charge you USD five every time you make over 6 withdrawals or transfers in a month, and an extra charge of $ ten per transaction. Nevertheless, if the amount in your Chase Plus Savings account is greater than USD 15,000, the bank might be prepared to waive this fee.

How a Chase Savings Account Works and What You Can Expect?

The following are some of the features of every Chase savings account:

- Automatic savings program

It requires discipline to pay yourself first even if you understand just how essential saving is.

The great thing is Chase provides an automated savings program which works with every account.

You are able to create recurring automatic transfers from your checking account to your savings account in case you’ve a Chase checking account. You’re accountable for figuring out the transfer schedule and quantity of each transfer.

- Overdraft protection

Overdrawing your account may occur as a result of an incorrect calculation or a forgotten transaction.

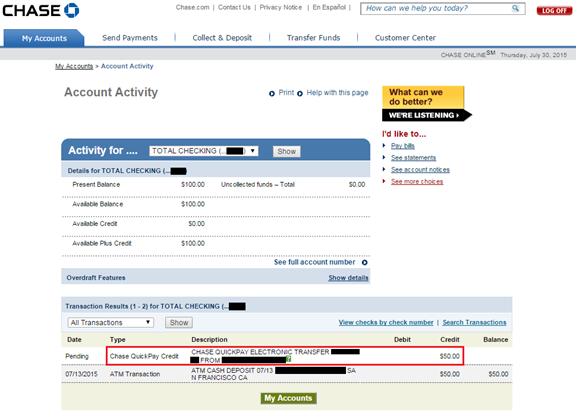

Overdraft protection from Whenever you link a Chase savings account to a Chase checking account, Chase Bank is going to be accessible. Overdraft protection can stop overdraft penalties from being imposed by transferring money from your savings account to cover the transaction.

It’s absolutely free to sign up for overdraft protection. At this time of writing, Chase charges a charge of USD ten overdraft protection per transfer (fee waived for Chase Premier Platinum accounts).

- Online/mobile banking

Online banking is possible, and it simplifies the banking procedure. So long as you’ve Internet access, you are able to deal with your Chase savings account from any place. That is true 7 days per week, 24 hours each day.

Transmit cash, create alerts, and keep track of the activities on your bank account. You are able to also download the bank’s mobile app and make use of it to keep tabs on your account from anyplace, no matter if you do not wish to be at a computer.

- Code for a Chase savings account.

If you open an account with Chase Bank and produce a checking or savings account regularly, you are able to get a sign-up bonus.

To obtain the present deal, you have to start a brand-new Chase savings account and deposit a minimum of USD 10,000 into the account within 10 business days, or keep a balance of USD 10,000 for ninety days.

You can go to any Chase savings account site as well as bring the coupon to any of their stores. If you’re not able to make the most of the discount, be on the lookout for upcoming offers.